Over 62% of third-party sellers contribute to Amazon’s total sales. Many of these are small startups that achieve early operating profitability but hit a wall when it comes to scaling. This is where Amazon aggregators come in, investment firms that acquire, consolidate, and scale Amazon FBA businesses.

Building on this momentum, over 90 Amazon aggregators have evolved. Since 2020, aggregators have collectively raised more than $12 billion to acquire FBA brands. However, the sector has seen profits, bankruptcies, and restructurings.

This article thoroughly explores Amazon FBA aggregators from a seller’s perspective. Let’s dig in to find out more!

1. What Are Amazon Aggregators?

Amazon aggregators are investment firms that acquire successful Amazon FBA (Fulfillment by Amazon) businesses with the goal of scaling them for increased profitability.

Rather than building new brands from the ground up, these firms focus on taking over existing successful small businesses. They optimize listings, invest in areas like marketing and logistics, and expand to other selling channels to grow these acquired brands.

Aggregators meticulously evaluate businesses based on their financial performance before making acquisition decisions.

What Type of Amazon Accounts Do Aggregators Target?

Aggregators look out for potentially lucrative businesses that have room for scalability. They specifically target Amazon FBA-registered accounts and private-labelled products.

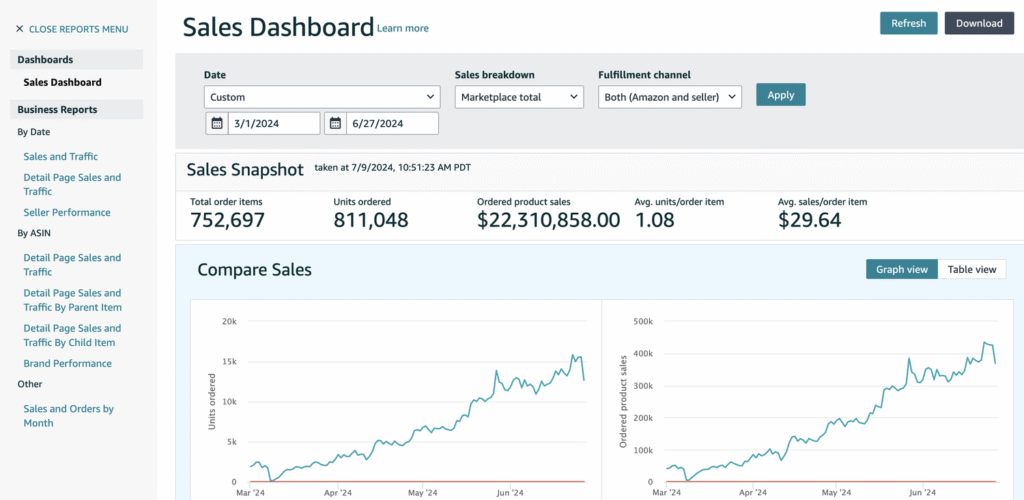

FBA businesses appeal to aggregators because Amazon handles storage, packing, and shipping, making logistics easier. Sellers also get access to a detailed dashboard through Seller Central, helping aggregators assess brand health. Plus, FBA products qualify for Amazon Prime, offering fast delivery, better visibility, and higher customer trust.

Below are the key factors that they look for in a potential business.

What They Look for in a Brand?

Amazon aggregators have a criterion to shortlist brands for acquisitions.

- Registered Brands: Aggregators look out for registered products, self-manufactured or ‘private’ labelled products.

- Revenue Metrics: Investors analyse the brand’s profit margins. Businesses should have at least $200k annual net worth and a minimum 10% revenue to be eligible. Get professional PPC services for strong financial statistics.

- Fewer SKUs: Every Amazon product and its variations have an assigned SKU (Stock Keeping Unit). Businesses with fewer SKUs plus good revenue output are manageable and profitable. They earn strong revenue with a smaller inventory and easier logistics, compared to sellers who manage more products but make the same income.

- Growth Potential: Investors study market demands and prefer brands that have a higher scope for the future.

- Alternative Selling Channels: Having an alternative sales channel for your product gives your brand an edge over others.

- No black hat: The seller account should have a clear history and no such engagement that can deactivate your account.

2. Should You Sell Your Brand to an Aggregator?

Entrepreneurs often build successful brands on Amazon. Yet, managing these businesses can become challenging, particularly when it’s not their long-term focus. For those with the capital to scale, but a desire to explore new ventures, it is best to exit the Amazon brand through an aggregator for a substantial payout.

As an entrepreneur, whether you choose to move forward for Amazon’s lucrative potential or give away the business to an aggregator, it comes with its own benefits and drawbacks.

Pros:

- Smooth exit from Amazon rather than hustling with conventional buyers.

- Better valuation of the brand.

- Immediate, upfront payment.

- Streamlined, efficient acquisition process.

- Deal for an earnout post-acquisition.

Cons:

- Competition from similar product brands, reducing payment.

- Loss of brand autonomy.

- Incredible/Bankruptcy of aggregators.

How Much Will They Pay?

Aggregators evaluate the scope and potential of your brand to decide a payout. The more boxes you tick on the aggregator’s checklist, the better the payout is guaranteed.

- Annual Sales: Most aggregators look out for businesses that have annual sales between $500,000 – $1 million.

- Equity Deal: Mostly, sellers take a full cash exit. However, some may offer a small equity when you wish to stay connected with the business. The equity deal sizes are small compared to a full buyout.

- Earn-outs: Some investors offer an earn-out based on the performance of the business. They are usually time-specific (for 1 to 5 years) and paid if the profit margins are met consistently.

The data on aggregators’ deal size is not disclosed. However, here is a breakdown of different deal sizes in 2021 as estimated by the Fortia Group:

| 6 figure deal | 7 figure deal | 8 figure deal | |

| Deals Closed | 23 | 34 | 2 |

| Approximate Deal Value | $500,000 | $2,500,000 | $11,000,000 |

| Average Sales Multiple | 41 | 45 | 64 |

3. Top Amazon Aggregators in 2025 (USA)

The aggregators’ ecosystem has expanded significantly in the past three years, with over 70% of firms centered in the USA. Below are the top acquiring Amazon Aggregators in 2025 (USA).

| Investor | Founded | Funding |

| Thrasio | 2018 | $3.4 billion |

| Infinite Commerce | 2020 | $1.1 billion |

| Growve | 2018 | $400 million |

| Boosted Commerce | 2019 | $380 million |

| Intrinsic | 2021 | $128 million |

| Monolith Brand Groups | 2020 | $230 million |

Amazon FBA Acquirers That Are Bankrupt or Defunct

Since 2023, many investors have either restructured, merged, or halted operations completely.

| Investor | Founded | Country | Status |

| Sorfeo | 2020 | USA | Bankrupt |

| Suma Brand | 2020 | USA | Merged with D1 and now The Ambr Group |

| SellerX | 2020 | Germany | Nonaccrual (Under heavy debt but yet to declare bankruptcy) |

| Tapuya Brands | 2021 | USA | Acquired by Pilot Wave |

| Benitago Group | 2016 | USA | Bankrupt |

| Boopos | 2021 | Spain | Business Model Restructured (Financing/Lending Businesses) |

| Elevate Brands | 2017 | USA | Non-acquiring |

4. How to Prepare Your Brand for Acquisition

Treat your FBA account as an asset to bid on higher deals with aggregators. The investors prefer optimized and well-documented brands.

Improve Brand Health:

- Strong Brand Profile: Investors like streamlined brand profiles that are already fully optimized. Market the product with logos for visibility and impose proper SOPs for product handling, packaging, and management.

- Consistent Profits: Build a solid financial resume by aiming consistently for a 10-20% profit margin.

- Solid Marketing: Attach high-quality product pictures and create an organized product profile. Monitor reviews to ensure a quality check of the product manufacturing.

- Legal Documentation: Complete all legal documentation and stay compliant with Amazon policies to build a trustworthy brand.

Your product is the best marketing tool for a higher valuation. Partner with Impact Wolves to get professional PPC management to strengthen brand health and its acquisition potential.

How to Find a Suitable Aggregator?

Here is how you can find a suitable aggregator:

- Explore Aggregators: Join seller forums or use online marketplaces to find global aggregators. Find a list of active and top-performing aggregators for the year 2025. Compare based on acquired brands, niches, and business sizes.

- Question Them: Explore suitable aggregators and ask them relevant questions thoroughly:

- What is the payment mode: Upfront or Earnout?

- Will they offer any equity?

- The financial backing of the investor.

- Post-acquisition growth route of your business.

- Set a Deal: Use free valuation tools to assess your business. Reach out to an aggregator for valuation and deal size. Involve brokers for closing a deal.

- Verify Credibility: Confirm their legitimacy before entering a Letter of Intent (LoI). Conduct a background check with testimonials and brand growth of previous acquisitions. Do not confirm a deal until you are completely positive.

5. Red Flags to Watch Before Selling

Acquisition offers from an Amazon aggregator sound intimidating. Watch out for these red flags before selling your brand:

- Vague Payout Deal: Delayed or constantly shifting terms is an alert to look out for a scam. Similarly, an over-reliance on post-acquisition earnouts and poor communication can indicate significant disorganization.

- Aggressive Acquisition: Understand the business model and analyze the previous acquisitions. Some aggregators solely focus on aggressive acquisition rather than improving the scalability of pre-acquired brands.

- No Scalability Plan: Some low-funded aggregators lack expertise in managing operations and scalability. See previous brand success stories and inquire about a solid roadmap for your brand. Around 60% of aggregators failed to streamline operations.

- Check Track Record: Aggregators with no LinkedIn, no testimonials, and no portfolio are straightforwardly suspicious.

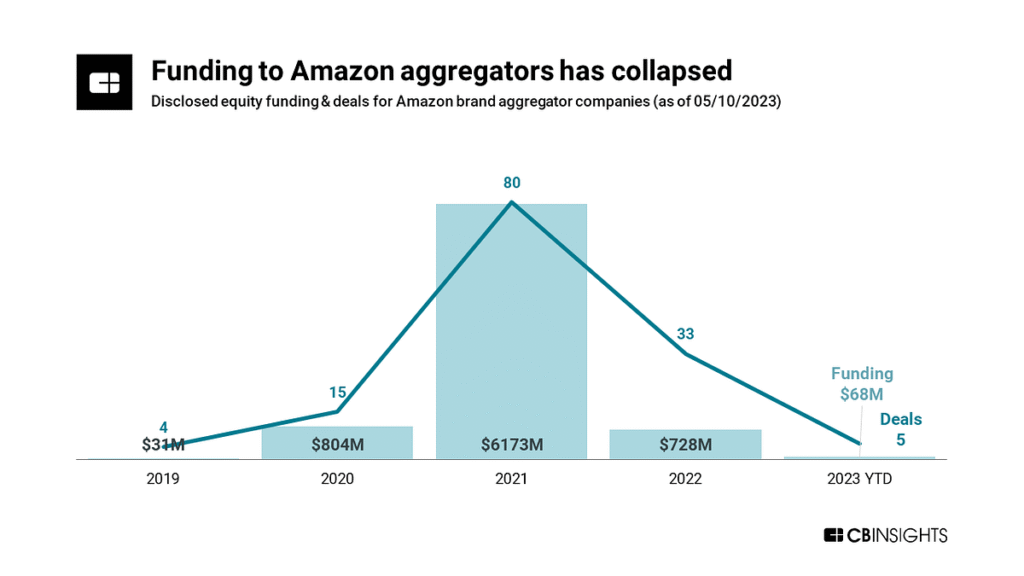

- Weak Financial Backing: In-debt aggregators have liquidity issues. To assess their financial health, request and review their financing structure. In 2022, the funding by aggregators fell by over 50% indicating caution.

Is Amazon Aggregator Dead?

The Aggregator model saw a boom in the covid-19 era, when online shopping skyrocketed. Bigger aggregators raised billions in funding by acquiring small and medium sized businesses. By 2021, they collectively funded around $10 billion.

However, the operations suddenly terminated in 2022. Interest rates rose and with covid fading away consumers were back to in-store shopping. Revenues fell sharply, profits collapsed and Amazon seller fee increased.

The funding decreased from $16 billion in 2021 to just a few million in 2022. Many aggregators filed for bankruptcy. Others started layoffs, mergers, or restructuring to keep it running. The Amazon aggregators aren’t dead entirely. However, since the market shift, they’ve become more low-profile and highly selective in their acquisitions.

6. Alternatives to Amazon Aggregators

Amazon aggregators might not be an instant and reliable solution to sell your brand. Here are a few better alternatives:

- Revenue-Based Scalability:

If your business has the potential but lacks financing, use business incubators to scale it for bigger profits. Wayfare, Boopos, and Clearco offer business growth financing programs in exchange for a percentage of your sales. They are a great opportunity to expand without losing autonomy over your brand.

- Online Business Bidding:

Directly sell your Amazon brand through reputable online business marketplaces. There are investors who look out for established brands. Set your own terms and get a higher valuation through bidding.

Some verified marketplaces are: Empire Flippers and Flippa. These applications allow you to get deals from global investors and exit business at your own terms.

Will Amazon Aggregator Thrive or Flop in coming years ?

byu/FatBlackwater inFulfillmentByAmazon

7. FAQs

Can I stay with my brand post-acquisition?

Yes. Some aggregators allow brand owners to continue working with them post-acquisition. However, this entirely depends on the terms signed in the agreement.

Do I need to use a broker to sell to an aggregator?

No. Brokers can help finalize a deal or negotiate. But you can approach and negotiate a deal yourself with an aggregator as well.

Can I sell if my brand isn’t trademarked or registered under Amazon Brand Registry?

Yes, you can. However, aggregators prefer trademarked or registered accounts to avoid counterfeits and jeopardize their reputation.

Final Thoughts: Is It Worth Selling in 2025?

The Amazon aggregator ecosystem has slowed down since its boom in 2021. The aggregators are still actively consolidating, yet have become more selective. Others have restructured to focus on already acquired businesses.

As an Amazon seller, if you want to venture elsewhere and have an annual net worth of at least $5 million, you can exit the business with an Amazon aggregator. However, it’s often more beneficial to strategize the growth of your new businesses first, rather than immediately exiting.

Build a solid portfolio with Impact Wolves to leverage your capital and raise valuation. Use our amazing PPC management services for brand visibility to improve profits.